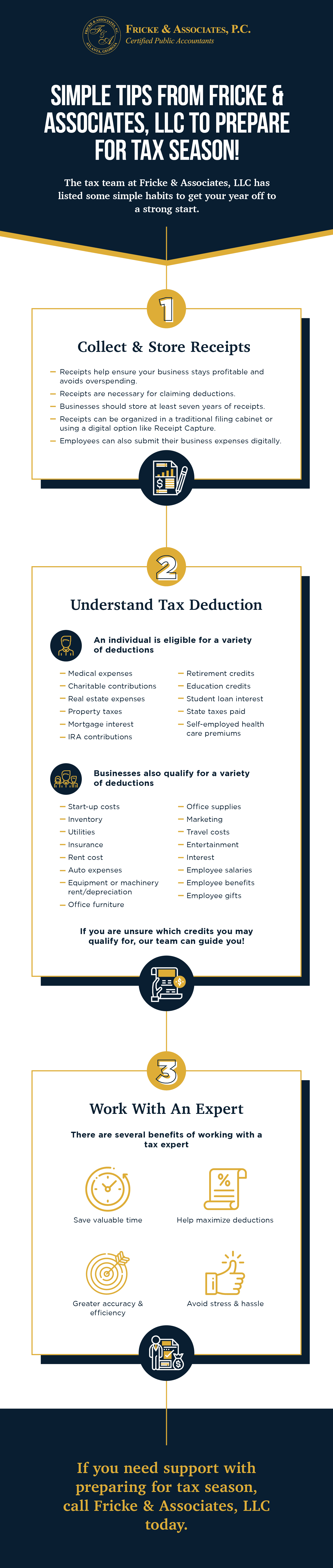

Do you have a New Year’s resolution? The start of a new year can be a great time to establish new healthy habits. Whether filing as an individual or for your business, organizing your taxes for the upcoming season is a great resolution. When your documents are in order, you avoid stress and hassle when the filing date is approaching. Also, you will be more likely to complete your taxes correctly. Follow these simple habits from our tax team at Fricke & Associates, LLC to get your year off to a strong start.

· Keep Track of Receipts—For businesses, receipts should be kept for approximately seven years, so you need a system in place to keep them all organized. You can choose to keep your receipts organized in a traditional filing cabinet or using a digital option like a receipt capture app. Receipt capture apps store all your receipts safely and help you form a digital paper trail. You can also set up the app to let your employees submit their business expenses digitally. Whether you go paperless or not, develop a system to collect and store receipts. Receipts help ensure your business stays profitable and avoids overspending. Also, receipts are necessary for claiming deductions.

· Understand Deductibles—If filing as an individual, there are a variety of deductions you may be eligible for. Common itemized deductibles include medical expenses, charitable contributions, real estate expenses, property taxes, mortgage interest, IRA contributions, retirement credits, education credits, student loan interest, state taxes paid, and self-employed health care premiums. Businesses can qualify for deductions as well, such as start-up costs, inventory, utilities, insurance, rent cost, auto expenses, equipment or machinery rent/depreciation, office furniture, office supplies, marketing, travel costs, entertainment, interest, employee salaries, employee benefits, employee gifts, and more. If you are unsure which credits you may qualify for, our team can provide guidance. We can help make sure that you are not paying more than you should this tax season.

· Hire Your Tax Preparation Expert—Choosing a professional to complete your taxes will pay for itself through saving valuable time and maximizing deductions. Our team is well-versed in the latest tax laws and also the available deductions for individuals and businesses. Since we are experts in the field, we can complete your taxes with greater accuracy and efficiency. You can spend your weekend doing something you enjoy instead of deciphering the tax instructions and completing the forms. We will make sure to take every appropriate deduction to ensure you are not overpaying. Peace of mind and free time are both valuable for any hard-working business professional or individual.

If you need support with preparing for tax season, reach out to Fricke & Associates, LLC. We are standing by to help make this tax year smooth.