Between the pandemic and the state of the economy, the last couple of years have been a roller coaster ride for small businesses. The tax bills that small businesses face can feel even more challenging when you are just trying to maintain financial stability amid difficult times. Managing the taxes for your small business doesn’t have to be painful, and when you are better prepared, you can often decrease what you owe. Taxes are one of the biggest costs and most important bills associated with running a small business. Business owners that file their taxes late, inaccurately, or avoid them altogether face fines or, in extreme cases, criminal prosecution.

The good news? Small-business taxes aren’t as complex as you might think. Here are four tax tips to consider for small businesses.

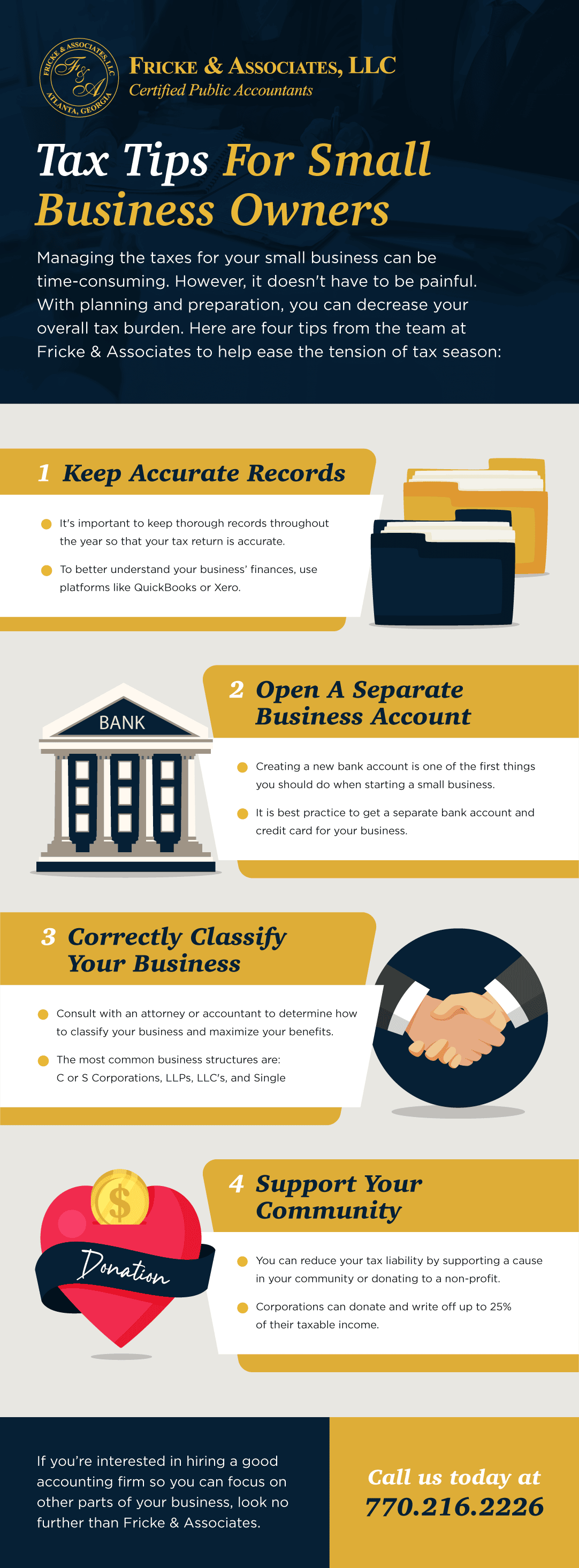

1. Keep thorough records

Keeping thorough records throughout the year will ensure your tax return is correct. With inadequate record keeping, you could miss out on deductions or put yourself at risk for an audit. One way to keep accurate records is to invest in accounting software. Tax season will be much easier to navigate if you have accurate reports. Often human error can miscategorize something, which can end up affecting your bottom line. Accounting software exists to solve those problems. Platforms like QuickBooks, and Xero, save time, reduce errors, and automatically create reports that’ll help you understand your business’ finances.

2. Separate business from personal expenses

The first thing you should do when starting a small business is to create a new bank account.

One of the simplest and most common ways to get into tax trouble is mixing your personal expenses with business expenses. The IRS could start looking at your personal accounts because of commingled money. It is best practice to get a separate bank account and credit card for your business and run only business expenses through those accounts. Having separate bank accounts for both business and personal transactions makes tax time easier. Not only will you have clean, accurate records for the expenses you’re writing off, but it will keep personal transactions private.

3. Correctly classify your business

It’s important to consult with an attorney and accountant to determine how to classify your business. Failing to classify your business properly can result in overpaying taxes. Deciding whether to classify your company as either a C Corporation, S Corporation, Limited Liability Partnership, Limited Liability Company, Single Member LLC or Sole Proprietor will affect your taxes differently.

4. Make a charitable donation

Whether you’re supporting a cause in your community or donating to a non-profit, small businesses can reduce their tax liability by making charitable contributions. Corporations can donate and write off up to 25% of its taxable income. Supporting organizations that share your values is not just a tax-saving tip, it enables you to connect with your customers. Consumers are more likely to purchase from companies with strong brand values. Supporting local causes is a great way to let your customers know what you care about.

All of these tips will help ease the overwhelm of tax season. But, the most important thing you could do when it comes to taxes for your small business? Hire the right accountant.

Hands down, hiring an accountant instead of juggling it all yourself can make all the difference. You didn’t get into your business to be an accountant. Free up your time to and offload your tax filing to Fricke & Associates. Often we can help you legally reduce your tax liability. Ideally, you’ll work with us throughout the year, not just in March or April for tax season. A good accounting firm like Fricke & Associates can be vital to growth and survival for most small businesses. As true experts in all areas of the tax and accounting industry, we will give you personalized tax advice based on your business structure. Our 22 years in the business allow us to really understand your challenges as a small business owner and step in to meet your tax and accounting needs. Let us know how we can help!