What are the New Changes?

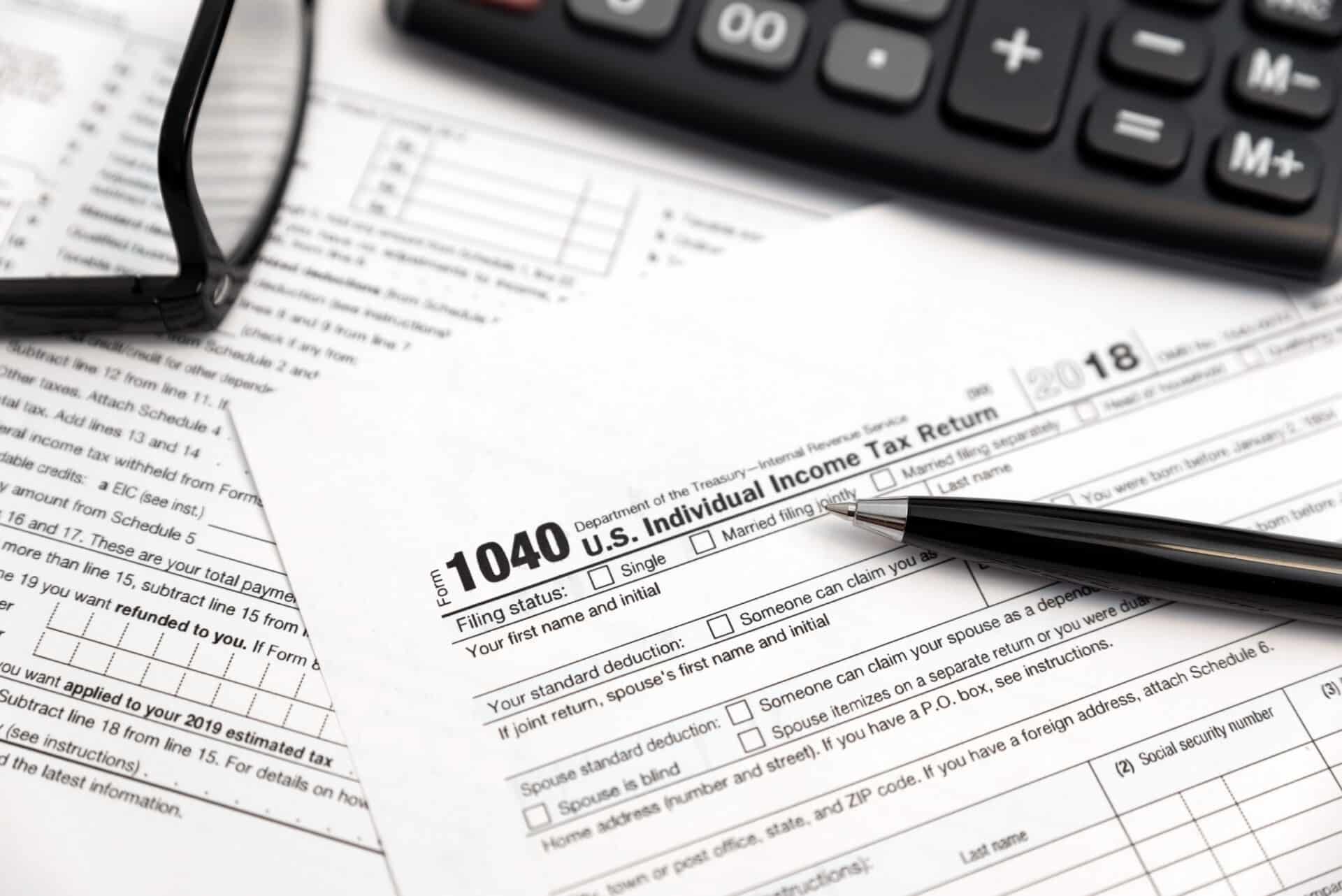

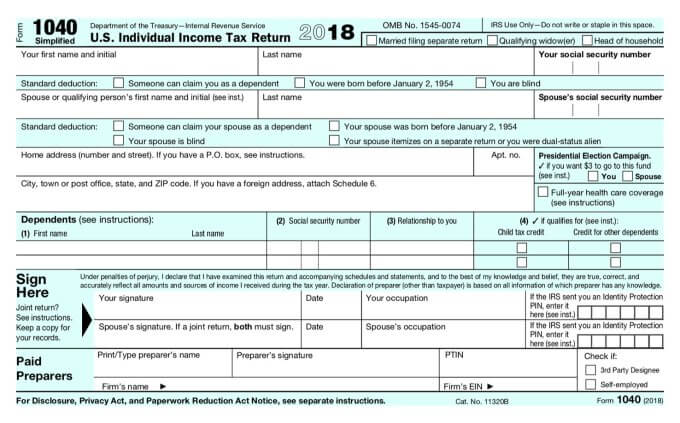

The year 2018 saw many tax provision changes. As a result of these changes, there are numerous lines on the current 1040 that are no longer relevant. For example, as of the 2018 tax year, no one will be eligible to claim personal exemptions. In keeping with this tax regulation, the IRS and the Treasury Department have removed the personal exemption line from the new, simplified Form 1040.

While the new 1040 has only 23 lines compared to the 79 lines contained in the old form, it is important to note that the new 1040 doesn’t eliminate that many tax provisions. Some provisions have been consolidated to simplify the new form. For example, the lines listing any tax credits you qualify for and tax payments you’ve made have been consolidated into just two lines.

Who Needs to Submit the New Form 1040?

The IRS estimates that around 65 percent of all American taxpayers will need to submit the new Form 1040. If you use a professional tax preparer or tax preparation software, you may not notice the changes to the 1040, as the appropriate forms are selected and electronically filed for you. If, however, you submit paper returns, you may find the new 1040 much less comprehensive than the 1040, 1040EZ, or 1040A forms that you’ve submitted in the past.

Which Additional Schedules Can Be Added to the New 1040?

For those whose tax situations are not straightforward, the IRS will provide a new Schedule 1 form that can be attached to Form 1040. If, for example, you have capital gains or receive unemployment benefits, you may attach Schedule 1 to your return. Schedule 1 can also be used by those who are self-employed or receive any other Form 1099 income. The old lettered Schedules (C, D, E, and F) will still be available and must be submitted along with the new Schedule 1.

If you’re claiming any tax credits aside from dependent credits, you’ll need to fill out and submit Schedule 3 with your return. Schedule 4 needs to be completed by anyone who owes self-employment tax, net investment income tax, or a penalty for not having health insurance.

How Can I Get More Information About the New 1040?

If you still have questions or would like more information about how the new 1040 affects your tax situation, we can help. Contact Fricke & Associates, LLC and one of our tax specialists can give you more information about whether the updated 1040 applies to you.